Dear Potential Partner:

Welcome, and… Congratulations!

And if you're wondering why congratulations are in order, there's a logical reason. Read on!

If you currently have, or aspire to have, $3,000,000 or more set aside for retirement, you'd be among the wealthiest seven percent of all Americans… and that's a compliment to your personal achievements. It should also explain the exclusive nature of this invitation.

It's "exclusive" because we so carefully select the individuals we invite to Partner with Cartel Equity Fund, LLC: Those who've demonstrated a sincere desire to achieve and retain personal wealth.

Cartel Equity Fund, LLC is not a "tied-in", high-pressure sales organization or commissioned brokerage in demand of quick decisions or funding. We’re a Venture Capital Fund, structured as a Partnership, and organized to acquire stock in qualifying private companies preparing for an IPO, Merger or, Acquisition.

I'm sure you’re aware that small investors have seldom been made privy to purchasing stock in private companies prior to their going public. That is, until now!

Our current mission is simply stated:

- If you're concerned about your retirement like most people are today;

- If your IRA, 401K, or any part of your current investment portfolio has decreased in value, or not significantly increased;

- If your broker or financial advisor is telling you to "brave the market'', or, indeed;

- If you're tired of dealing with commissioned brokers and paying fees for services, or, Insurance Rep's who offer "5% Annuity Returns"...

…You need to know more about Cartel Equity Fund, LLC, the truth about venture capital and the potential of low risk, high return investing!

If you're a seriously inclined investor who, up until now, has not been privy to buying into private companies prior to their "going public" like the "big wigs" do, Cartel Equity can provide you a no fee partnership opportunity to do so with no commissioned brokers to remove you from your money!

Cartel Equity Fund, LLC is a venture capital investment partnership whose principals "put their money where their mouth is". We conservatively and methodically go about acquiring stock in qualifying private companies ("Acquisitions") for the benefit of taking them public.

Once we elect to "buy into" a qualifying company, we, the principals of Cartel Equity, commit our personal funds and years of management and marketing experience to become the Fund's Initial Investors.

When, on those special occasions -such as now- an Acquisition in our Fund appears to be far more viable than the norm, we invite a select number of accredited “small investors” to join with us by offering them a limited percentage of our fully paid-in position in the Acquisition. This provides our Partnership the opportunity to enhance its “small investor” base while at the same time, our new “small investors” the opportunity to enjoy the profit potentials that are normally only open to Institutional and Pension Fund Investors as "early investors" in promising IPO's.

Possibly you've heard it said: "There's no such thing as smart money. Only smart people. The money just goes where they go." To that extent, I believe you'll be proud and happy to become an investor along with me and many others who, like yourself I'm sure, are astute, informed and forward-thinking investors.

With sincerest professional regards,

Cartel Equity Fund, LLC

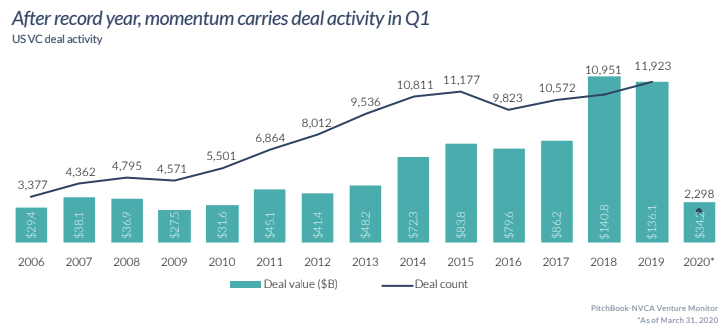

U.S. venture capital investors poured $34.2 billion into startups during the first quarter of 2020.

Total VC investments reached a record $140.8 billion in 2018, and $136 billion in 2019 and, in spite of the Corona virus...“At 2020’s End...IPO Valuations Were At The Highest Level Since The Dot-Com Area!"

Airbnb's Stock Price Skyrockets In Market Debut as IPOs Boom

Airbnb Inc.'s shares more than doubled in their trading debut, reflecting a soaring market for new stock listings and the home-sharing company’s ability to navigate the coronavirus-induced downturn in travel this year.

The stock began trading at $146 on the Nasdaq Stock Market, higher than its initial-public-offering price of $68 a share and ended the day worth $100.7 billion.

"People are just compelled to be invested," said Jim Cooney, head of Americas equity-capital markets at Bank of America Corp. So far in 2020, more than $155 billion has been raised by venture capital on U.S. exchanges, far exceeding the previous full-year record set at the height of the dot-com boom in 1999, according to Dealogic... "And that's what we do" said Don Wilson, CEO, Cartel Equity Fund, LLC. "We're now looking forward to the myriad IPO's and profit sharing FranCap represents. We like keeping our investors Happy, Wealthy & Wise!"